How Nodestock works

A deep dive into the graph architecture, sentiment engine, and event propagation system that powers Nodestock.

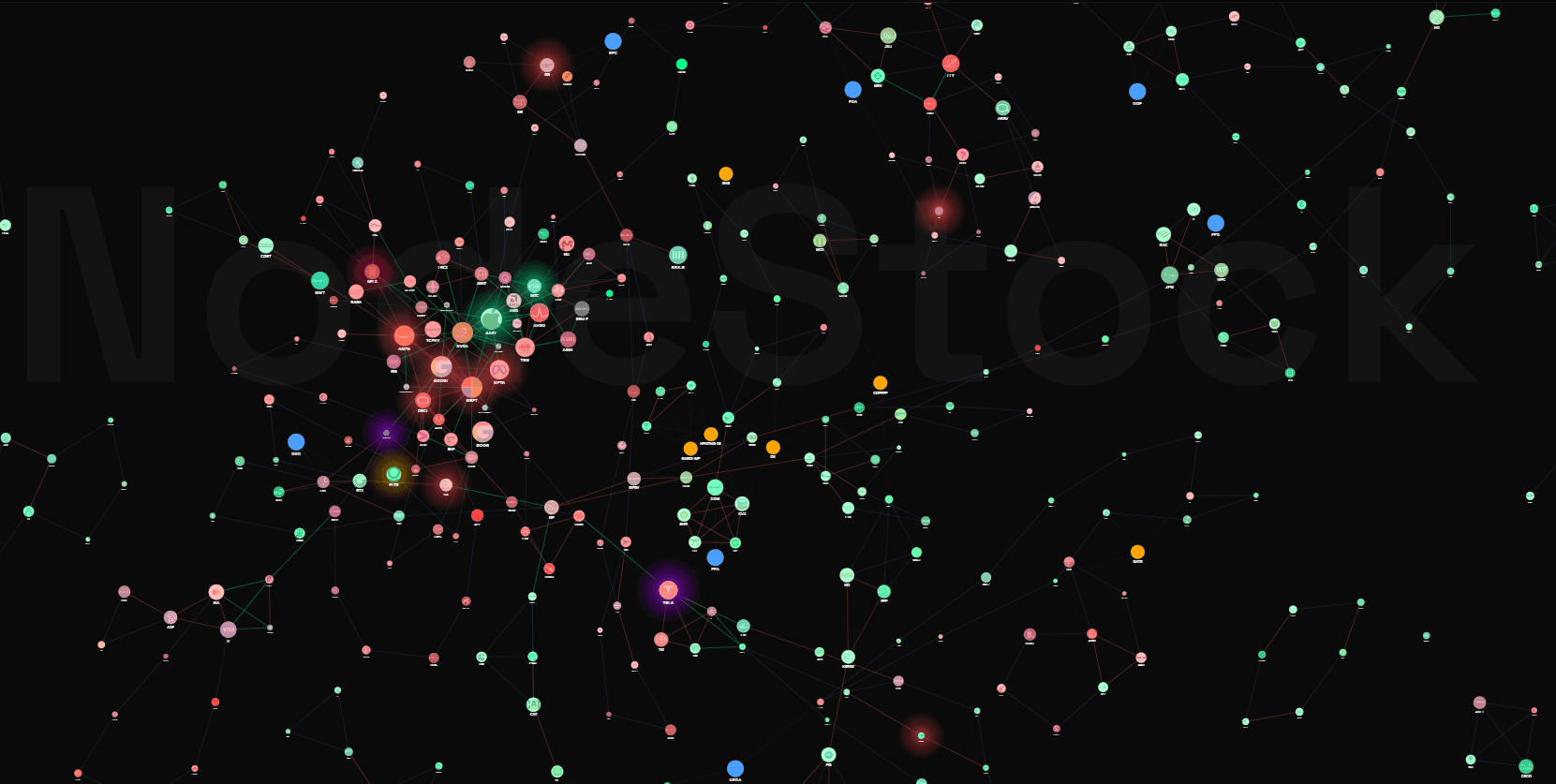

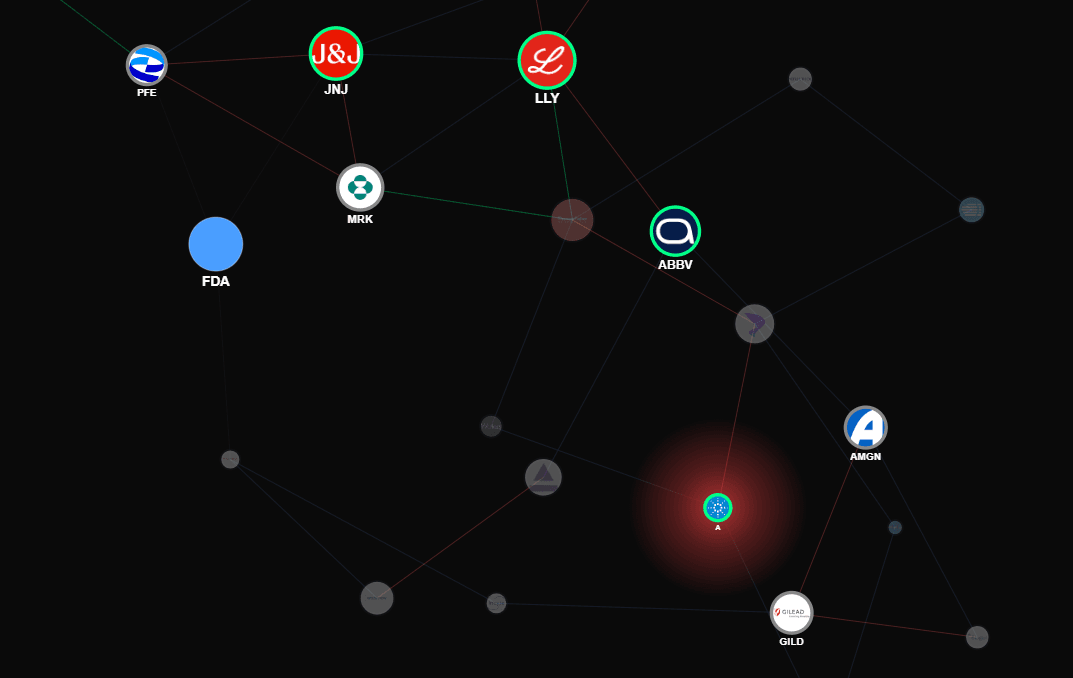

Nodes: The building blocks

Each entity in the market—from S&P 500 companies to commodities to regulators—is a node. Nodes carry real-time sentiment, market data, and connections to other entities.

- ✓Companies: AAPL, MSFT, NVDA, JPM, XOM, and 500+ more

- ✓Commodities: Oil, gold, natural gas, FX pairs

- ✓Regulators: Federal Reserve, SEC, FDA, FCC

- ✓Indexes: S&P 500, Russell 2000, Nasdaq 100

- ✓Private & Modeled: Pre-IPO companies, comparable peers

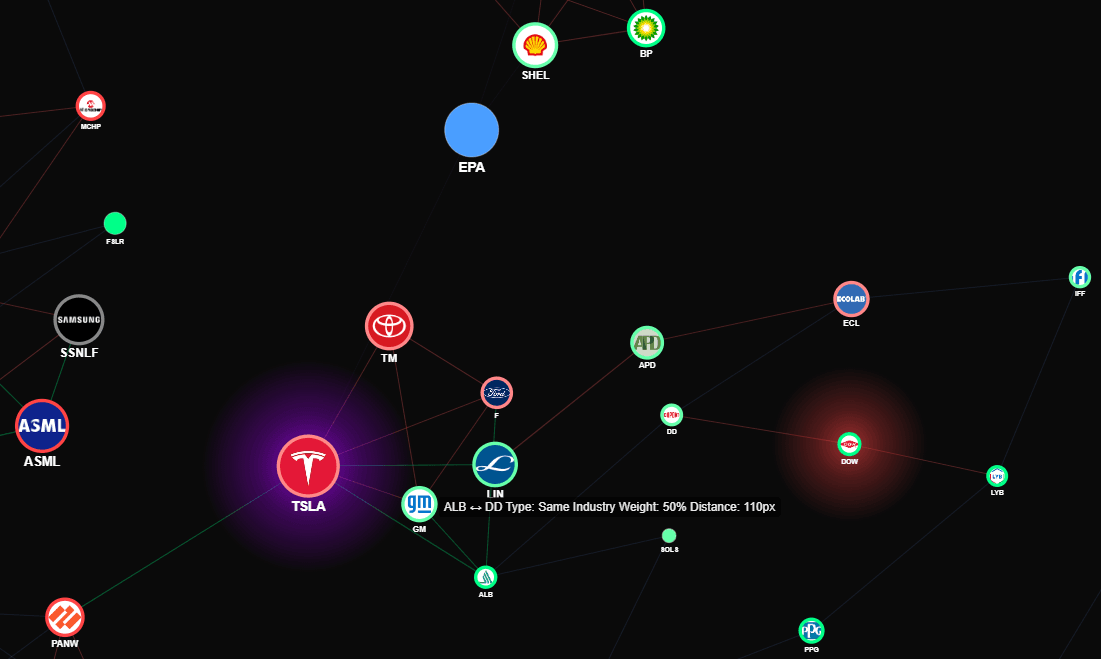

Edges: The relationships

Edges connect nodes and encode the nature of the relationship. Strength indicates intensity.

- ✓Supply Chain: Component dependencies

- ✓Competition: Direct market rivals

- ✓Regulation: Policy exposure and compliance

- ✓Macro Exposure: Broad economic factors

- ✓Correlation: Observed price movements

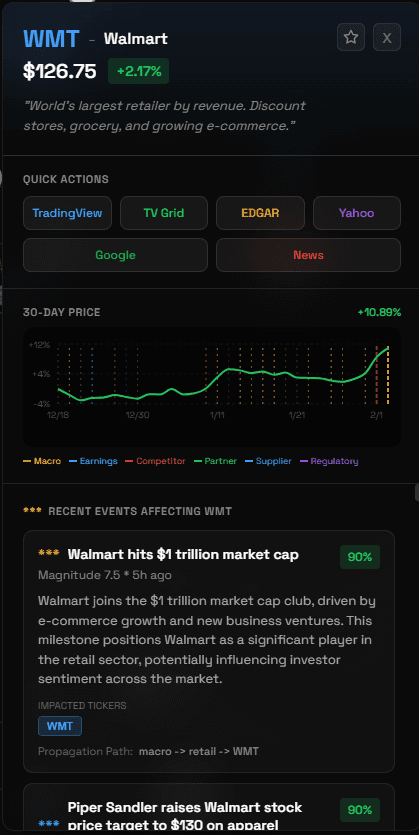

Sentiment: The signal

We compute sentiment continuously by analyzing trusted data sources. Each node has a real-time sentiment score: bullish, neutral, or bearish.

- ✓Sourced from: Earnings transcripts, news, SEC filings, market data

- ✓Updated: Every 15 minutes (Pro), or real-time (Team)

- ✓Confidence: Each score includes a confidence interval

- ✓Historical: Full sentiment history for backtesting

Earthquakes: The alerts

Major market events trigger "earthquake" detection. We compute which nodes are impacted and how the shock propagates through the network.

- ✓Event detection: Earnings surprises, regulatory decisions, market gaps

- ✓Propagation modeling: Simulation based on graph algorithms

- ✓Confidence scoring: Probabilistic impact estimates

- ✓Real-time alerting: SMS/email for Pro+ tiers